Automatic Compliance

We take care of many compliance tasks so you can focus on your business.

Our fully integrated, easy-to-use system makes payroll pain a thing of the past.

New hires have their information synced to payroll immediately so they can get up and running on their first day.

When you use the Zenefits time and scheduling tools, hours worked, breaks, and time off are all automatically synced to payroll.

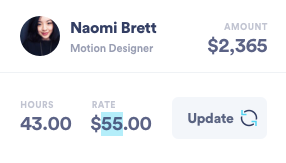

With Zenefits, you’ll never have to enter the same information twice. Update a worker’s salary or hourly rate once and you’re all set.

Calculating time off can be a complicated headache. We’ll run the math so you can return to work -- with every element automatically fed into payroll.

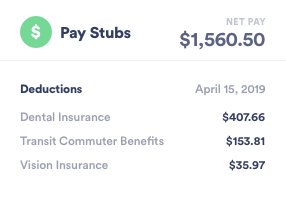

When an employee enrolls in a benefits plan, we’ll automatically calculate and execute the proper deductions.

Celebrate their joining the team instead of thinking about money. Our payroll automatically determines their start date and prorates their first payment.

Missing payroll would be a nightmare, so we make sure you never do.

Our dynamic pay stubs give employees all the information they need, including mobile access, deductions breakdowns, and clearer information. You’ll never again have to answer, “What’s a reimbursement? Is it taxable?”

Easily communicate any special payments, including bonuses, special commissions, and more.

Double check your work before finalizing a payrun.

Take actions for entire teams--like bonuses or commissions--saving time and avoiding mistakes.

Workers can access their documents even after they’ve left, so you won’t have to field questions from former employees.

Provide your workers the convenience they expect.

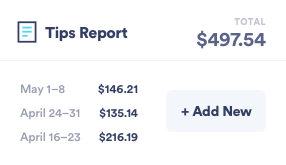

Restaurants and other businesses can use Zenefits payroll to report on tips.

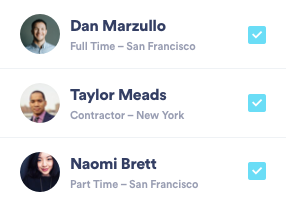

Use Zenefits to pay all your workers, whether they are full-time employees, contractors, freelancers, or consultants.

Have the flexibility to include the right number of deductions for your business.

If you need more earning codes, you can create your own.

Get detailed breakdowns on the costs associated with your biggest expense - your people. Capture and analyze data by department, location, position, or even customize codes.

Assign and calculate different pay rates based on multiple positions, matching the needs of your specific compensation strategy.

Zenefits accurately calculates compliant amounts for garnishment withholding and automatically sets aside those sums. We also support you in remitting payments to Child Support agencies.

Payroll is your largest cost - understand it and make better decisions going forward.

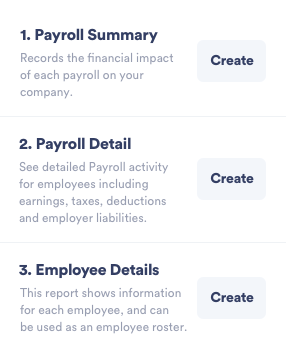

Generate payroll reports that can be brought into your accounting systems with ease. Or, if spreadsheets aren’t your thing, we have direct integrations with top accounting software providers.

Understand how payroll expenses are distributed across different labor types.

Zenefits’ many reports help you get a better understanding of your business and how you’re paying your people.

We handle the most common forms at the federal, state and local levels for employees (excluding US territories). We also handle 1099 filings to the IRS.

We automatically notify the right state when an employee is hired.

We take care of many compliance tasks so you can focus on your business.